Overtime premium pay calculator

Pay on a specified day once a month. Recruitment Relocation Retention Incentives.

Overtime Calculator Workest

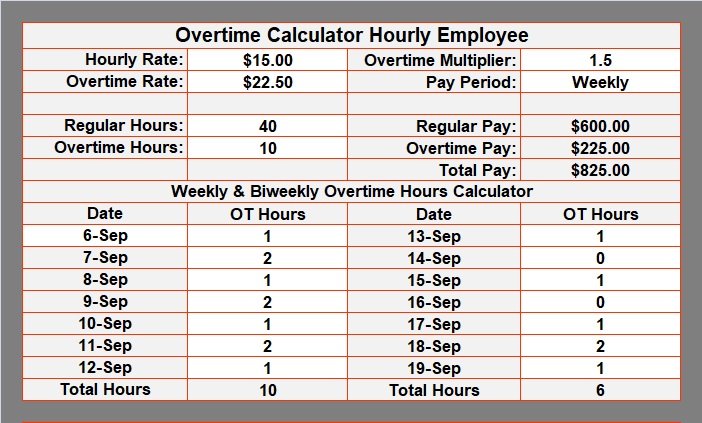

You adjust the overtime rates accordingly.

. Select your LTD coverage option. Therefore New Jerseys overtime minimum wage is 1950 per hour one and a half times the regular New Jersey minimum wage of 1300 per hour. The regular rate of pay for the workweek is all of the earnings divided by the hours worked.

Pay every other week generally on the same day each pay period. For premium rate Double Time multiply your hourly rate by 2. You can also.

The Pay Rate Calculator is not a substitute for pay calculations in the Payroll Management System. Click on Print to take a hard copy of the timesheet. FLSA overtime pay for Federal law enforcement employees under section 7k would be applied on a biweekly basis if a weekly basis is not used Instead of a 40-hour weekly overtime threshold the weekly overtime threshold is 4275 hours or 855.

If a Data Record is currently selected in the Data tab this line will list the name you gave to that data record. The calculator will display your total pay. For more information about predisability earnings please review your LTD Plan Booklet.

Overtime pay also called time and a half pay is one and a half times an employees normal hourly wage. Enter your hourly rate and click on Calculate. The regular rate wages straight time for the workweek are 70000.

2144 x 12 hours 25728. Straight Time Rate of Pay x All Overtime Hours Worked. A Data Record is a set of calculator entries that are stored in your web browsers Local Storage.

Predisability earnings do not include overtime shift differential pay standby pay or other extra compensation. One-half x Hourly Regular Rate of Pay x All Overtime Hours Worked. VacationLeave Accrual.

Pay rates can increase up to 60 from the base rate depending on assignment location. Basic Pay 85760. 1196 x 12 hours 14352.

2011 51 Cal4th 1191 1206 The California Labor Code does apply to overtime work performed in California for a California-based employer by out-of-state plaintiffs in the circumstances of this case such that overtime pay is required for work in excess of eight hours per day or in excess of 40 hours per week. Overtime pay also called time and a half pay is one and a half times an employees normal hourly wage. 60000 10000 70000.

An employer doesnt violate overtime laws by requiring employees to work overtime ie mandatory overtime as long as they are properly compensated at the premium rate. If no data record is selected or you have no entries stored for this calculator the line will display None. Total FLSA Overtime Pay 40080 25728 14352.

Night Pay 8560. The FLSA requires overtime pay for the last three hours of his shift 35 hours worked 8-hour shift 43. Trooper pay is based upon geographical assignment.

05 x 2391 1196. 1400 x 10 hours x 5. Pay each week generally on the same day each pay period.

The premium overtime rate equals one-half the regular rate times the number of hours over 40 in a workweek. Your overtime hours begin after 40 hoursweek and you specify that under the overtime tab. Pay 4 times a year.

It also mandates that employees. Overtime is considered any hours worked over 40 hours per workweek and the pay for overtime hours is at least one-and-a-half times an employees regular pay rate. You can click on Clear All to clear all the fields.

Pay 2 times a year. In the event of a conflict between the information from the Pay Rate Calculator. Use this bi-weekly time card calculator to track two weeks of work at a time.

For instance for Hourly Rate 2600 the Premium Rate at Double Time 2600 X 2 5200. Back Pay Calculator Toggle submenu. Chriss premium pay is 54 per hour 45 basic hourly rate x 12 shift differential.

Pay on specified dates twice a month usually on the fifteenth and thirtieth. Therefore Michigans overtime minimum wage is 1481 per hour one and a half times the regular Michigan minimum wage of 987 per hour. Tracking time on a bi-weekly or semi-monthly basis means your payroll department saves time on processing.

Employee-Paid LTD Premium Calculator OK. Exclusions exemptions from the overtime pay regulations follow the federal Fair Labor Standards Act FLSAHowever the minimum weekly salary that must be paid on a guaranteed basis to an employee who is classified as exempt under the executive and administrative employee exemptions is higher than the federal minimum of 455 per week. Defines overtime pay as a rule that nonexempt employees receive pay for the time they work in excess of 40 hours per week.

Ready To Use Overtime Calculator Template With Payslip Msofficegeek

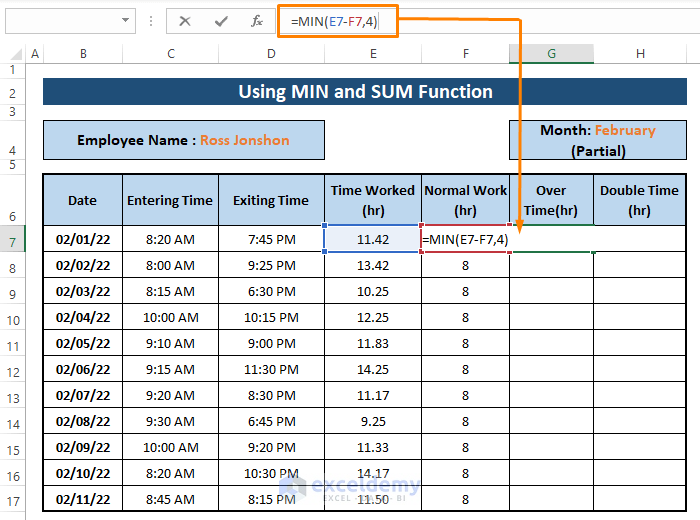

Excel Formula To Calculate Overtime And Double Time 3 Ways

Overtime Pay Calculators

Overtime Calculator Gpetrium

Excel Formula Basic Overtime Calculation Formula

Overtime Pay Calculators

Ready To Use Overtime Calculator Template With Payslip Msofficegeek

Free Time Card Calculator For Excel Card Templates Free Free Printable Card Templates Excel Templates

Excel Formula To Calculate Hours Worked And Overtime With Template Excel Formula Excel Life Skills

Free Online Overtime Calculator Time Analytics

Overtime Calculator Gpetrium

How To Calculate Overtime Pay For Employees In Malaysia Althr Blog

Overtime Calculator To Calculate Time And A Half Rate And More Conversion Calculator Mortgage Payment Calculator Loan Calculator

Overtime Pay Calculators

Download Employee Overtime Calculator Excel Template Exceldatapro Excel Templates Excel Shortcuts Excel

Overtime Calculator Gpetrium

Excel Formula Timesheet Overtime Calculation Formula Exceljet